Crypto derivatives strategies are no longer limited to experienced traders with coding skills. With AI tools, backtesting platforms, and automated or algo trading bots, you now have more ways to plan and execute trades without getting stuck in manual execution. Bots bring consistency and the ability to act on signals faster than you could on your own.

Delta Exchange, a leading crypto trading platform in India, focuses on crypto derivatives trading, giving you both planning tools and automation support. Whether you’re building strategies with crypto options or experimenting with futures and trackers, Delta makes it easier to connect ideas with execution. The mix of automated execution, safety, and INR-based trading is what more traders are leaning on today.

In this post, we’ll discuss more about Delta’s automated trading bot and how it helps you plan crypto derivatives strategies efficiently.

Crypto Derivatives on Delta Exchange

Crypto derivatives are financial contracts that let you trade on the price movement of cryptocurrencies without holding them directly. On Delta Exchange, you’ll find products like futures, options, and trackers that make it easier to gain exposure to major assets like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), and more.

India’s top crypto platform: Trade crypto futures and options on major cryptocurrencies

India’s top crypto platform: Trade crypto futures and options on major cryptocurrencies

You can use these contracts for hedging against price swings, speculating on short-term moves, or setting up income-focused trades through spreads and covered calls. Regardless of which approach you prefer, having a clear plan is essential. That’s where strategy planning comes in – before placing a trade, you need to think through payoff, risks, and exits.

Once your plan is set, automated trading bots can take care of the heavy lifting, leaving you to focus on refining your next move in the volatile market.

The Rise of Automated Trading Bots

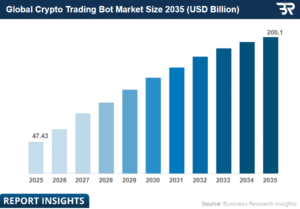

Automated trading is gaining momentum in crypto, and the numbers show why. The global crypto trading bot market is valued at $47+ billion in 2025, which is expected to hit $200+ billion by 2035, growing at a 14% CAGR. At the same time, the study also reveals that 42% of traders prefer bots in trading decisions.

The growth of automated trading bots in the crypto industry

This shift explains why crypto platforms such as Delta Exchange are building ways to connect crypto derivatives strategies with automation tools.

Here’s why its automated trading bots are becoming indispensable today for many new and experienced traders:

- They eliminate emotional decision-making, keeping you from reacting to social media or news hype.

- Speed and consistency help in 24/7/365 open markets where every second counts.

- Bots reduce risks by executing trades based on preset conditions, instead of giving in to market sentiments.

- They give you more room to plan strategies around futures and options without being glued to screens.

How Delta Exchange Supports Automated Trading Bots

Delta Exchange makes automated or algo trading bots accessible for anyone interested in running crypto derivatives strategies.

Here’s why it stands out:

- API access: Connect your strategies directly for full automation.

- TradingView automation: Turn your TradingView strategies into live trades using simple webhooks.

- Flexible use: You can run setups for multiple crypto derivatives strategies.

For example, you could create a bot to trade BTC options with pre-set stop-loss and profit targets, removing the need to monitor every move.

If you’re a beginner, you get a safe way to experiment, and if you’re an experienced trader, you gain the ability to scale complex futures and options setups across multiple instruments – either way, it’s a win-win.

Features of Crypto Trading Bots on Delta Exchange

Some key features of automated trading bots on Delta Exchange:

- No-code execution: You can automate even complex strategies without writing a single line of code – this makes it accessible for traders without technical expertise.

- Customizable alerts: Set alerts on strategies, indicators, or trend lines, and let the bot act on them instantly.

- Instant trade execution: Orders are placed in real time with minimal latency, so you don’t miss opportunities in fast-moving markets.

- Supports multiple crypto assets: Bots allow you to trade crypto futures and options on BTC, ETH, and other altcoins. Apart from these, currently, only BTC trackers are available on the platform.

- Built-in security: Every webhook URL is encrypted, keeping your automation process safe from unauthorized access.

- Error handling: Trade confirmations and error notifications are sent to your email, helping you spot and fix issues quickly.

The Bottomline

Automated trading bots don’t create strategies for you, but they make execution more disciplined and consistent. Pair that with Delta Exchange’s demo account, and you get a space where planning and automation come together. You can test new crypto derivatives strategies with small lot sizes, then scale them once you’re confident.

Whether you’re experimenting with BTC options or running bots for hedging and spread plays, Delta Exchange gives you the tools to handle it safely.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. Please conduct your own research and consult experts before making any investment decisions.